3 Reasons Why a Health Savings Account Might be Your Secret Weapon

A Health Savings Account can deliver significant tax benefits – today and in the future.

It’s tax time, you’ve just completed your taxes and are now just noticing the enormous tax bill you’ve paid over the past year. You start thinking, did you make a mistake? Is there something you can do this year to lower your upcoming tax bill?

The short answer, as for most things that are tax-related, is “it depends”. The tax code has several provisions that encourage individuals to save for retirement. You are probably aware of the opportunity to reduce taxes through maximizing the contributions to an employer-sponsored retirement account such as a 401(k). For 2018, that maximum contribution is set at $18,500, with a $6,000 catch-up for those 50 and older.

However, there may be another hidden opportunity that many people overlook. Those with access to a Health Savings Account (or HSA) may be able to boost their tax savings while also putting money away for the future.

Here is what you need to know.

HSA- How it works

A Health Savings Account allows you to set aside pre-tax funds to use later for qualified medical expenses. Contribution limits for 2018 are $3,450 for an individual and $6,850 for a family. Those 55 and older can contribute an additional $1,000 as a “catch-up” contribution. Keep in mind that these are total annual contribution limits from all sources, which may include your own funds, your employer, or a third party.

So why use an HSA as opposed to simply putting that money into a savings account or into a Flexible Spending Account? Here are three compelling reasons.

HSA funds are owned by you outright. Unlike a Flexible Spending Account, the balance carries over from year to year and is 100 percent portable in the event of employment change.

HSA tax benefits arrive in three stages: contributions are made on the pre-tax basis, which means that you are deferring income right now. Growth of the funds in the account are tax-free. Finally, withdrawals for qualified purposes (i.e. medical expenses) are tax-free.

Unlike some other income deferral options, a Health Savings Account has no income limitation. That makes it a good option for higher-income families looking to lower their tax liability.

What might that look like?

Let’s assume that we have a family of four with total household income of $250,000 currently taxed at 40 percent (combining Federal and State tax liability). By contributing to the HSA, they can decrease their taxable income by $6,850 (and save $2,740 on this year’s tax bill).

If the family needs access to those funds to cover a visit to the doctor – no problem! Health Savings Account funds can be withdrawn at any time to pay for (or get reimbursed for paying) qualified medical expenses. Those cover a broad range of services, from emergency ambulance transportation to annual physical exams and brain surgery. Individuals over 65 years old can also use tax-free HSA withdrawals to cover their Medicare premiums!

HSA potential- Power of Compounding

The benefits of an HSA don’t stop at the immediate tax deduction for your contribution. If HSA funds are invested, any gains are tax-free – assuming they are used for qualified medical. The power of compounded growth if you keep the funds invested can provide significant savings towards medical expenses down the road.

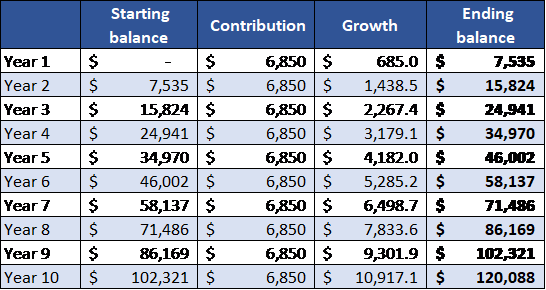

If our family of four from the example above invests the HSA balance into a well-diversified index fund (assuming an annual return of 10 percent, unchanged annual contribution limit, and no withdrawals), their health savings account will grow to over $120K in 10 years!

Of that, $68,500 is total contributions and over $51,000 in growth that is tax-free. They will also have saved $27,400 in taxes from their annual contributions during those 10 years.

The secret side of the HSA

There are two additional features that make the HSA a powerful planning tool in retirement – over and above the original purposes of covering future medical expenses.

Your HSA funds don’t have to go towards medical expenses – as long as you are willing to wait. If you don’t need the money in the Health Savings Account for medical expenses and you are at least 65 years old, you can use those funds just as if you would an Individual Retirement Account (or IRA) – for any reason without tax penalty; normal income taxes will apply on those withdrawals (similar to an IRA). This may be a useful way of supplementing retirement income. Think of it as your secret IRA.

(For more details on building a big-picture view of where your money comes from in retirement, read Where Do I Get My Money When I Retire?)

The second feature has to do with the HSA stipulation that qualified medical expenses can be reimbursed from the Health Savings Account at any time.

Why does this matter? Let’s assume that our imaginary family pays all ongoing medical bills out of pocket (as opposed to drawing down the HSA balance). Every time they pay a qualified medical bill, they save the receipt in a folder. Over the years, the stack of payment receipts grows. When the family is ready to access the money in the HSA, they simply pull together all the receipts and submit a reimbursement request. As a result, their HSA account balance has had the chance to grow untouched and tax-free for 10 years or more. The reimbursement is tax-free. And the family can use that money for any purpose – no strings attached.

Is an HSA right for you?

Health Savings Accounts can be a powerful means of optimizing your family’s tax situation today and building a safety net for the future. As any other tax planning tool, it isn’t right for everyone. Here are a few points you should consider before setting up an HSA.

An HSA usually goes along with a high-deductible health insurance plan. Depending on your personal, financial, and health history, this may or may not be the right move for you. Make sure that you evaluate the policy objectively and run a best- and worst-case expense projection based on various scenarios, from perfect health to an accident or a serious diagnosis. Make sure that you have enough reserves or ongoing cash flow to cover the relatively high deductible without compromising your access to medical care. Generally, if you don’t consume a lot of healthcare annually or anticipate increased out of pocket expenses, an HSA could be a great option.

If you struggle with tracking and organizing receipts, the path of paying medical expenses out of pocket with an eye to get reimbursed for them later may not work for you. Immaculate record-keeping is the key to making this strategy come together.

Not all HSAs are created equal. Be sure to ask about all account fees, as those seemingly minor percentage points and amounts can steadily eat away at the balance growth in the account.

That said, with increasing healthcare costs a Health Savings Account may be well-worth investigating. If your circumstances are right, this tool can provide a tremendous benefit by reducing your taxes today, setting you up to reap tax-free growth in the invested account, and making the funds available for paying (or getting reimbursed for) qualified medical in the future. If you are curious about how a Health Savings Account might help you and your family, give us a call!