6 Myths About IRA Investing

An IRA account, whether Traditional, Roth, or SEP is arguably one of the best investment vehicles for growing wealth. The tax advantages of these accounts can add up to thousands and even hundreds or thousands of dollars over time. What’s terrible is that many people in the United States are missing out on one of the best retirement opportunities because the myths I have listed below have scared them away. So let me clear these up so you can better understand and profit from these powerful retirement vehicles.

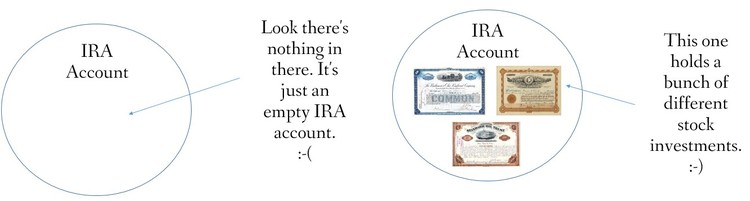

Myth 1: An IRA is a great investment!

Wrong. An IRA is just a type of account. It holds your investments, it’s not an investment itself. These investments could be just about anything but most typically are stocks and bonds. Think of it like this:

You can buy and sell these different investments within your IRA account. The IRA just means it’s protected against taxes. Kind of like this:

Myth 2: I can only invest my IRA where I open the account.

I've heard people say many times, “I have a Bank IRA” or “I have a Fidelity IRA”. Many investors think they can only invest their IRA at the bank or financial institution where they opened the account. Like I said, IRA’s can hold almost any type of investment but not all financial institutions offer every investment. So, if you IRA is at a bank the only investment option you might have is a bank CD. But that doesn't mean it has to be that way forever. You can always move it to a different company who provides more options for investment. Even after you have invested your IRA, you can transfer it to another financial institution through a direct transfer or a rollover.

Myth 3 - I can’t contribute to my 401(k) and an IRA in the same year.

Bogus! But according to Fidelity Investments, 52% of Americans who don’t have an IRA believe that they cannot contribute to both an IRA and workplace savings in the same year. The truth is you can always contribute to an IRA but depending on your income the contributions may not be tax deductible. There are different rules if you are married filing jointly and single. So check with a tax or investment professional before you rule yourself out. As well, the rules for a Roth IRA are different then the rules for a Traditional IRA. No matter what all of the IRA contributions will grow on a tax-deferred basis no matter what, level of income you earn.

Myth 4 - I own a small business, so I am not eligible to open an IRA.

Stop saying that! Most small business owners are unaware of the multitude of retirement plans that are available at their disposal. In addition to the Traditional and Roth IRA there are two other types of IRA plans specifically designed for business owners called a SEP IRA plan and a SIMPLE IRA plan. Each of these plans has different nuances to them depending on the income in the business, the number of employees, and the objective of the employer. The SEP IRA could potentially allow a small business owner to put as much as $52,000 in 2014 and $53,000 in 2015. Consult your financial advisor or tax specialist to find the best account type for you and your business.

Myth 5 - Only old people put money into IRA accounts.

On the contrary, the people who can benefit the most are the individuals who start saving the earliest. This is because of the concepts of time value of money and compounding interest. The earlier you save, the more compounding that will occur in your account. Even if you can’t afford the $5,500 maximum you should still contribute what you can. Even $500 to $1,000 per year in your IRA can grow significantly over time.

Myth 6 – My money is stuck in the account until the age of 59 ½ unless I pay a large penalty.

Most people believe that once money is invested in an IRA, that if you withdraw the funds before the age of 59 ½ there will be a 10% penalty imposed by the IRS. This is generally true, however, there is a concept called taking Substantial Equal Periodic Payments (Regulation 72t) which if followed correctly will allow you to take a minimum level of distribution without penalty before the age of 59 ½. You should consult a tax professional before deploying this strategy. If you put your money in a Roth IRA, because it is “after-tax” money, you can take your contributions out at any time for any reason without a penalty.

IRA’s are a powerful investment tool out there. Don’t miss out on any of the benefits because you’re not sure how they work. Schedule a meeting to discuss your IRA with Phillip James today!