Crippling epidemic of Student Loan Debt - Don't plan on retiring anytime soon.

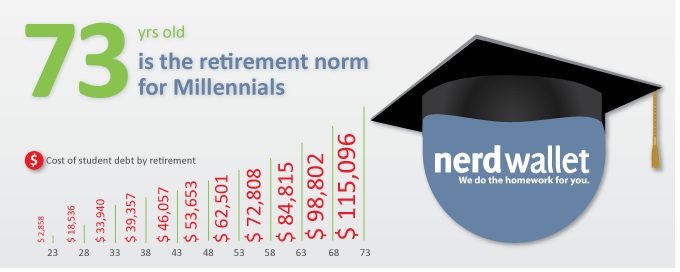

I saw this report on Nerd Wallet, a personal finance website, earlier today and it's not good news for Millenials. The cost of student loan debt is pushing the average retirement age to 73. This compares to the current average retirement age of 60 - 13 years later! I thought the standard of living was supposed to increase over time?

“The median debt load of $23,300 will cost students over $115,000 (in today’s dollars) by the time they retire.”

At least the article goes on to explain some ways to Beat the Odds. Some suggestions:

Employer 401(k) Match Is Crucial

Make Above-average Contributions To Retirement Accounts

Invest In Index Funds

Other Quick Facts On Students And Their Debt from the Article:

How do you compare?

Median debt for a student upon graduation: $23,300

Percentage of students who are unemployed at graduation: 18%

The median starting salary for those who do have jobs: $45,327

Standard loan repayment plan: 10 years

Average yearly loan repayment: $2,858

Number of college graduates currently estimated to be in default: Over 7 million

The moral of the story is start planning now to pay off your debt. Every generation has its challenges. With the proper plan you can still achieve your goals.