Social Security Planning Strategies to Consider

How to get the most from your Social Security Benefits

Social Security is a federal benefit program provided to most American workers which is designed to replace a percentage of an individual’s pre-retirement income. Benefit amounts are determined based on lifetime earnings along with the timing of when the individual elects to begin receiving the social security benefits. Higher lifetime earnings lead to a higher monthly benefit. The benefits are progressive, in that workers with lower average lifetime pay receive a higher percentage of their prior earnings compared to workers with higher average lifetime pay. Since many employers have moved away from defined-benefit pension plans, Social Security benefits have become most workers’ primary source of retirement income which is not subject to investment risk or market downswings.

Almost all workers participate in Social Security. During an individual’s working years, Social Security taxes are paid which are used to pay benefits to people who have already retired, disabled individuals, survivors of deceased workers, and dependents of beneficiaries. Social Security benefits are not means tested, meaning benefits are not denied to participants who have assets or income above certain levels. Generally, an individual needs to have a minimum of 10 years of earnings to qualify for the program. On average, social security benefits replace 40% of a worker’s pre-retirement income.

How is the benefit amount calculated?

The benefit amount an individual qualifies for is based on the highest 35 years of earnings that individual had. If there are fewer than 35 years with earnings, then years of no earnings are included among the 35 years. These wages are adjusted for inflation to equivalent amounts in the year the worker turns 60. A final indexed monthly earnings figure is developed as a result of the inflation adjusted 35 year earning average. A formula is then applied to this monthly earnings figure to determine the basic benefit amount. This basic amount is the benefit that an individual will receive at the full retirement age, which depends on the year the individual was born. Beginning at age 62, the individual’s benefit amount is adjusted for inflation each year based on the Consumer Price Index.

For workers born between the years 1943 and 1958, the monthly benefit amount is equal to 90% of the first $960 of their average monthly earnings, plus 32% of the next $4,825 earned, plus 15% of amounts above $5,785 per month up to a defined maximum monthly benefit amount.

Social Security benefits can be claimed as early as age 62, but benefits will be provided at a lower rate. This reduction applies to all future benefits the person receives. Alternatively, benefits can be taken at an age beyond the full retirement age up to age 70. For an individual born in 1960, the full retirement age is 67. For each month prior to age 67 that this individual takes benefits early, up to 36 months, the benefit amount is reduced by 0.56%. For each month early that benefits are taken beyond 36 months prior to the full retirement age, the monthly benefit amount is reduced an additional 0.42%.

In this scenario, if a worker elects to take benefits at age 62, the full monthly benefit amount is reduced by 30%. This is calculated by multiplying 36 months by the monthly reduction rate of 0.56%, and then an additional 24 months by the monthly reduction amount of 0.42%.

Benefits are increased each month beyond the full retirement age that they are not taken, up to age 70. By delaying benefits beyond full retirement age, the benefit amount increases by 8% per year.

Social Security and Taxes

Anywhere from zero up to 85% of Social Security benefits are treated as taxable income. For 2021, single filers with total income below $25,000 pay zero taxes on their Social Security benefits. For single filers with income between $25,000 and $34,000, taxes are owed on 50% of the Social Security benefits received. For single filers with income above $34,000, 85% of Social Security benefits received are subject to taxes.

Married couples with incomes below $32,000 pay zero taxes on Social Security benefits, couples with income between $32,000 and $44,000 pay income taxes on 50% of the Social Security benefits received, and couples with income above $44,000 pay income taxes on 85% of Social Security benefits received.

It is important to evaluate and understand the tax implications of Social Security benefits, as this can impact the overall strategy and ideal timing for deciding to claim benefits.

Deciding when to start receiving benefits

When an individual decides to begin receiving Social Security benefits and meets the requirements of the program, the benefits can be applied for at www.ssa.gov. Deciding the age at which benefits will begin can have a substantial financial impact on an individual. Factors to consider in deciding when to begin receiving benefits include an individual’s ability to cover living expenses without the benefits, general health, life expectancy, and whether a spouse plans to file for spousal benefits. Taxes and investment opportunities should also be taken into consideration.

Jim was born in 1960, which means his full retirement age is 67. He turns 62 next year and is evaluating his Social Security benefit to determine which year he would like to begin receiving the payments. After adjusting for inflation, Jim’s average earnings from his 35 highest paid working years is $10,000 per month. Jim will receive 90% of the first $960 in monthly earnings, 32% of the next $4,875 earned, and 15% of the remaining $4,215 of his $10,000 monthly earnings amount. This equates to a monthly Social Security benefit amount of $3,040 which is 30% of his lifetime average monthly earnings figure.

If Jim elects to begin receiving his Social Security benefit the day he turns 62, his full benefit amount will be reduced by a total of 30% from $3,040 to $2,128. This benefit amount will be indexed for inflation each year, and this will be the amount that Jim would receive throughout the duration of his life. This includes a reduction of 6.67% per year for the three years prior to his full retirement age, plus an additional 5% reduction per year for the fourth and fifth years prior to his full retirement age. If Jim instead chooses to delay his benefit until age 70, his benefit amount increases by 8% per year or 24% in total from $3,040 to $3,770, which would then also be indexed for inflation annually.

Jim’s decision in this scenario ultimately comes down to the factors discussed previously. His ability to afford his living expenses without the benefits, life expectancy, general health, and tax situation all come into play.

When does delaying Social Security make sense?

In the scenario previously discussed, Jim’s benefit increases by 24% from $3,040 to $3,770 if he delays collecting his benefit until age 70. If Jim can afford to delay his benefit without impacting his ability to cover his cost of living, an analysis should be completed on whether his long-term financial condition is improved or deteriorated as a result of delaying the benefit.

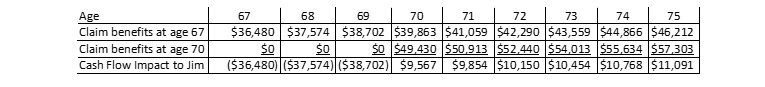

This analysis can be completed by reviewing the net cash flow impact to Jim each year as a result of delaying the benefit, and then completing an IRR (Internal Rate of Return) calculation on those cash flows to understand Jim’s annualized return. The following figures were developed assuming a 3% annual cost of living adjustment for inflation.

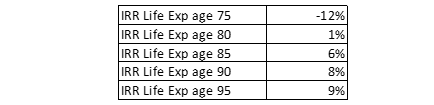

Jim experiences a negative financial impact from the day he turns 67 up until he turns 70 due to not receiving the Social Security income he could have otherwise received. The IRR analysis completed at various life expectancy points reveals the point in which Jim’s return becomes positive and exceeds various return levels.

If Jim were to pass away at age 75, just 5 years after claiming his benefits, then he experiences a negative annual return of 12%. He missed out on a total of $112,756 in Social Security benefits from age 67 up to age 70, and only recovered an incremental $50,794 during the four years that followed. Alternatively, if Jim lives to be 85, he experiences an annual return of 6%. It is important to note that this 6% return is not subject to market risk and as a result can be considered superior to many other forms of investments. The annualized returns increase to 8% if Jim lives to age 90, and 9% for age 95. The breakeven point at which Jim’s IRR becomes positive is between ages 79 and 80.

An alternative method for completing this analysis would be to determine the time value of money, or minimum acceptable return an individual requires to delay Social Security, and then complete a NPV (Net Present Value) analysis using that percentage figure as the discount rate. If this time value of money percentage is equal to 5% in this scenario, then an individual would need to live to be 84 years old to break even.

Utilizing Low Income Years Prior to Social Security

Another potential planning strategy is to delay social security, allowing you to take advantage of your lower income years. If you are like a lot of retirees, a lot of your nest egg is tied up in tax deferred accounts. Once you are no longer working your wage income goes away. Assuming you don’t start Social Security and other income streams, like a pension, right away, you will be in a very low tax bracket (10%, 12%, or 15% (after 2025 Tax Sunset)) for the first few years of retirement. This could be a great time to “create income” by converting some of your tax deferred dollars to Roth IRA and pay taxes in these lower brackets. Then once social security is being paid out you could be a in a higher tax bracket and any dollar taken out of your IRA/401(k) will be taxed at a potentially higher marginal rate. As well, getting money out before the age of 72 will help you decrease the amount of your RMDs (Required Minimum Distributions).

Doing this type of planning will not only save you on taxes by pulling the money out in a lower tax bracket but also improve your overall withdrawal strategy, increasing liquidity, improving asset location, providing tax liquidity for unforeseen expenses, reduce future RMDs, and improving the tax status for potential heirs. While this strategy can get a little complicated, as it requires multi-year tax projections, it should be well worth your time as the tax savings can be dramatic.

Spousal considerations

The decision on the timing for claiming Social Security benefits requires more thought and analysis when a couple is making the decision. For a married couple, a surviving spouse is eligible to receive the partner’s full benefit when one individual passes away. For this reason, in many cases it is logical to delay collection on the higher earning spouse’s benefits since this benefit amount can be collected by either spouse throughout the duration of their lives. This increases the chances that a higher benefit amount will be collected for an extended period of time.

It is also important to note that the surviving spouse can only receive the higher of either partner’s monthly Social Security benefit amount. For this reason, in many cases it is wise for the lower earning spouse to not delay claiming the benefit as this individual may ultimately be collecting the higher earning spouse’s benefit regardless of whether their own benefit is delayed.

Summary

The decision on the timing of when to claim Social Security benefits should be based on a number of factors including one’s ability to cover existing living expenses without the benefit, life expectancy, and spousal considerations. For a healthy individual with a high life expectancy, delaying Social Security can provide a fixed rate of return which is backed by the federal government. This provides a return that is not subject to market fluctuations, with the primary risk being that of mortality risk. Even for an early retiree, delaying benefits can be beneficial due to the relatively high fixed return that can be achieved as a result. Anticipated market returns, inflationary pressures, and an individual’s available investment opportunities are all additional considerations one should keep in mind when making this important decision.