Sources of Retirement Income and Social Security

Retirement planning is often a client's number one goal. Therefore it is critically important to know your sources of income during retirement.

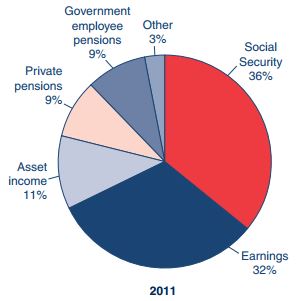

According to the Social Security Administration below are the sources of income (2011 most recent data). On average Social Security makes up over a third of a retirees income. This is sometimes a lot more. This can be a concern given that Social Security is headed for insolvency by 2033.

From the SSA Fast Facts & Figures 2013:

"Social Security is not sustainable over the long term at current benefit and tax rates. In 2010, the program paid more in benefits and expenses than it collected in taxes and other non-interest income, and the 2013 Trustees Report projects this pattern to continue for the next 75 years. The Trustees estimate that the trust fund reserves will be exhausted by 2033. At that point, payroll taxes and other income will flow into the fund but will be sufficient to pay only about 75% of program costs."

If you will be retiring at some point in the future (most people are planning on it), be prepared for some change to take place, possibly a reduction in benefits.

The best way to prepare is perform a retirement needs analysis which will provide the following:

1. Establishes the financial snapshot of where you are currently in relation to where you want to be at retirement

2. Establishes necessary savings objectives and identifies variables for consideration

3. Provides alternative scenarios based on changing variables (i.e. reduction in social security benefits).

Let me know if you need help preparing your own plan.