The sad story of the Behavior Gap

Investors, have you heard of the Behavior Gap? This is a huge problem that not even your financial planner is immune to.

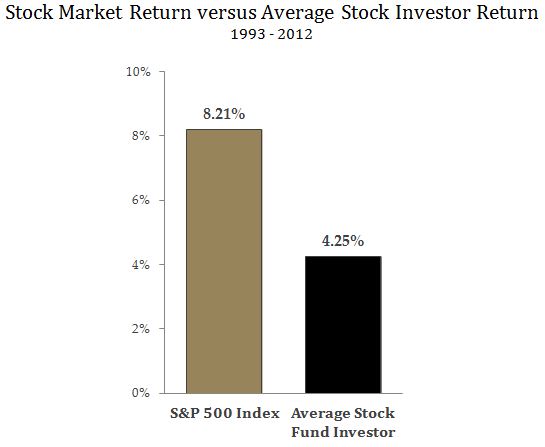

Below you will find one of the saddest graphs I have ever seen in my investing career. It shows something that is referred to as the “Behavior Gap.” The behavior gap is the difference between the return of the average mutual fund and the return of the average mutual fund investor. The saddest part about it is that the returns of the stock market are simply there for the taking. All the investor had to do was buy-and-hold. In reality most investors sold when the markets were down and bought when the markets were up. I don’t blame them; market timing is one of the hardest things in the world. You can do better then the average investor by investing passively in low-cost globally diversified index funds. Don’t be Average – Invest Passively. Buy, hold, and rebalance. Spend your time determining the correct asset allocation (% invested in stocks and the % invested in Bonds). This is driven by your individual financial goals and risk profile.

Not even brokers and financial planners are immune to market fluctuations. There was a survey done in 2011 by Bob Veres that showed 83% of financial planners moved away from buy-and-hold and instead went tactical and attempted to time the market. Whether they did this on their own accord or were pressured by nervous clients is not as important as the vast amount of lost wealth caused by this type of behavior. If your advisor told you to move to cash, money-market, or Bank CDs during the recent financial crisis (or any crisis for that matter) then they have fallen into the “Behavior Gap” and it may be time to look at other options.

How does the individual investor avoid this disastrous market timing trap, when even the trusted advisors are running scared? They must have a plan and stick to it. With the proper financial plan (and the proper financial planner) an investor can be a “patient investor” knowing that any cash that is needed from the portfolio in the next few years has already been invested in short-term high-grade bonds or the equivalent – mostly immune to market fluctuations. With this done the rest of the portfolio can be invested in the stock market confidently – this investor actually looks forward to every drop in the market. They see it as an opportunity to purchase the same great stocks but at discount pricing. The 2008 market crash was a gift from the investing gods. The people who used the opportunity to purchase more stocks are the heroes of this story. And they will be during the next crisis as well.

BEWARE of the Behavior Gap. The best protection is the proper plan which takes into consideration your personal goals, cash flows, and risk profile. Until you have this you won’t be able to invest your portfolio the right way, that way that will help you avoid the behavior gap.

Be Above Average – Invest Passively