The Definitive Guide To Using Bonds In Your Portfolio

Understand How Bonds Work To Protect Yourself From Rising Interest Rates And The Next Bear Market.

Equities are the hero of the day. The stock market surge, sparked by the presidential election, has won the hearts of investors. In the meantime, bonds have been left in the shadows.

Though many are eager to turn their backs on fixed-income, this is a critical time to reevaluate bond holdings in your portfolio. Why? Your bonds may be at risk amid rising rates from the Federal Reserve. In this article, we will look at how impending rate hikes present a risk to bond holdings and why short-term, high-grade bonds are the solution.

Keeping Your Head Above Water In A Rising Tide

A strengthening job market and upward trending inflation have emboldened Federal Reserve Chair Janet Yellen to deliver on her commitment to start raising interest rates. If the key factors of employment and inflation continue to rise “further adjustment of the federal funds rate would likely be appropriate,” remarked Yellen.[1] These comments should alert bondholders because rising interest rates result in falling bond prices. This kind of environment has not been seen for quite a while.

For several decades interest rates have dropped. In 1981 “the 30-year Treasury yielded 15%; in 1991, it was 8%; in 2001, 5%; today, it is half that,”[2] remarked a journalist at Kiplinger. These falling rates caused rising bond prices. Today, the story is different amid a defrosting global financial crisis. Rates are creeping up. This movement is motivated, in part, by the Fed, and will drive bond prices down. These changes, which are outside the control of investors, underscore an often-ignored truth about bonds: they can be as risky as stocks.

Investors only need to look back as far as 2013 to see how tumultuous the bond market can be. At the end of 2012, the 10-Year Treasury Rate stood at 1.93 percent. However, in 2013 the rate increased ending the year at 3.01%. This sharp rise took a toll on Vanguard’s Extended Duration Treasury Bond ETF (EDV). These rising rates meant the fund lost 21.66 percent for the year. A new bond investor would be shocked to learn that this traditionally “safe” investment could shed nearly a quarter of its value.

Yellen’s intention to increase inflation can accelerate the phenomenon seen with EDV’s performance. When inflation rises, we see too much money chasing too few goods. Resultantly, the purchasing power of the dollar declines. This drop motivates investors to seek greater compensation when lending. After all, they will need more income to afford the same basket of goods that was once cheaper.

In January of 2016, the CPI for all urban consumers was 238. As of January of this year, it rose to 244 marking an increase of 2.45 percent. This rising inflation will likely strengthen Yellen’s resolve thereby decreasing bond prices. While some meet Yellen's comments with skepticism, the backroom dealings speak volumes. “Behind closed doors, however, officials were laying the groundwork for raising short-term borrowing costs, the minutes showed,” remarked The Wall Street Journal.[3]

With these relationships clearly defined bond investors need to reevaluate before the rate hikes take effect. What is the best way to safeguard your holdings? Focus on short-term bonds that enjoy high-grade ratings. Let’s look at both of these characteristics.

Short And Sweet

Short-term bonds are less sensitive to increasing rates. However, investors seeking the historically stronger performance of long-term bonds have long eschewed them. Short-term bonds are primed for their moment in today’s environment of expected rate increases. Why? Their shorter duration makes them more able to weather the anticipated Federal Reserve moves. Let’s take a closer look at what duration means and why it’s important.

Duration is expressed as a number of years and indicates the sensitivity a bond has to changing rates. Imagine you hold a bond with a duration of five years. This figure means that after five years of collecting coupon payments you will have received a sum equal to the purchase price of the bond. That is, duration is linked to the coupon payments. A bond’s duration gradually decreases as the timeline to the maturity date shortens.

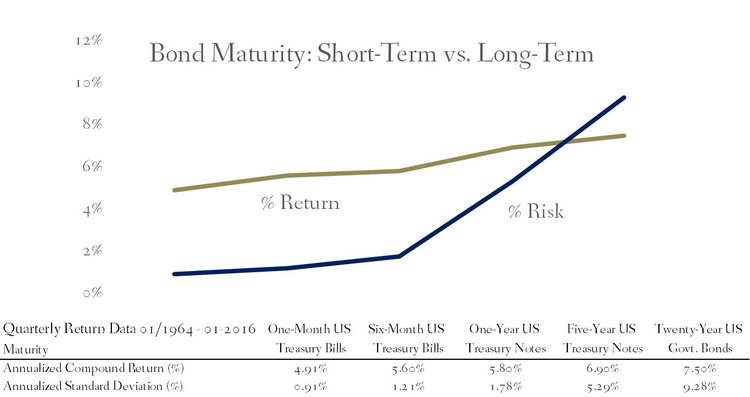

Rate of Return and Standard Deviation of Bonds Based on Maturity

Investors holding short-term bonds are faced with a shorter duration and therefore lower risk amid increasing rates. Resultantly, those same investors can use the proceeds from their soon-to-maturing bonds to purchase new bonds that will feature higher yields.

Historically, there have been only a few, limited periods during which short-term rates increased. Specifically, since 1985 there have been five periods where the two-year Treasury yield rose. Within these spans, we see that returns on short-term bonds increases. This relationship illustrates the power of short-term bonds during times of increased rates.[4]

Bond investors today enjoy the rare privilege of knowing what the future holds: higher rates. Yellen’s remarks have been clear and signal great advantages for opportunistic investors. “As the economy approaches our objectives, it makes sense to gradually reduce the level of monetary policy support,"[5] stated Yellen in mid-February. Tough short-term bonds are not without risk the current direction of our policymakers creates a robust reward to offset this reasonable level of risk. Under these circumstances bonds with maturities of three to five years are wise.

While Yellen and her team broadcast clear intentions, Trump remains vague concerning policy. Equity investors appear willing to take it on faith that Trump will be friendly to businesses. Regulatory easing, infrastructure spending, and tax reductions are all believed to be on deck. However, these initiatives remain in the background as immigration headlines have dominated the media. In the meantime, many are waiting to see if he delivers jobs and wage growth to supporters still reeling from the recession.

Trepidations will continue to develop until rhetoric converts to policy. Bond investors can manage this economic risk by remaining cognizant of not only short-term maturities but also bond ratings.

Seek High-Grade When Seeking High Ground

Bond investors must pay special attention to ratings amid uncertain times like these. Major rating agencies like Moody’s, Standard & Poor’s, and Fitch deem a bond worthy of a grade ranging from “AAA” (low risk) to “D” (in default, or serious risk of default). Low-grade bonds (“junk bonds”) must offer high yields to compensate investors for incurring high risk. Ratings help bond investors understand the future risks by assessing the credit quality of the issuing company. Ratings have significant influence over a bond’s interest rate and pricing. Is the rating the most important characteristic of a bond? Absolutely not, after all, who watches the Watchmen?

Rate of Return and Standard Deviation of bonds Based on Credit Quality

Bond rating agencies are as fallible as the people running them and as the saying goes, "to err is human." Some of these sanctimonious agencies have been on the payrolls of major firms. Conflicts of interest can arise as a result. One such case was the global financial crisis. Lauded rating agencies awarded “AAA” ratings to some collateralized debt obligations (CDOs). These instruments were most directly responsible for decimated markets in the wake of the 2008 disaster. Investors believed their “AAA” holdings to be safe when in fact they were toxic.

But I Won’t Get Paid?

So you might be wondering if all your bonds are super-safe then you won’t be earning a good rate of return. Well it’s true that you will be earning less in yield than other bonds but with return comes risk. There is no getting around it. My suggestion to you is that if that if you want to take more risk in hopes of getting more return you should be doing so in stocks. By doing so you are getting paid a better rate of return for taking on the additional risk.

To determine how much to allocate to stocks and bonds you need to do a little planning. Start by thinking about all the cash you are going to need from your portfolio for the next 5, 10, and even 15 years. This cash should not be invested in risky assets. This is because you don’t want to be selling your investments when the markets are down to fund your spending goals. Instead invest this cash in high-grade, short-term bonds. By doing this you have whatever cash you need from the portfolio ready to be used even if we are in the middle of a bear market. Then, the rest of your portfolio can confidently invested in stocks.

Think about it. Even if we have another correction like in 2008 when stocks were down about 50%, short-term, high-grade bonds were down only slightly or in some cases even up (depending on which time period you are looking at). This means you could completely ignore the bear market, knowing that you didn’t have to sell any of your stocks when the market was down. Are you starting to get the idea? <see The Role of Bonds in Your Portfolio>

A sound bond investing strategy relies on a dimensional assessment of risk. Therefore, do a little planning and consider short-term bonds with high-grade ratings. Take a moment to understand the company issuing the bond and whether you consider the risk acceptable. Diversification is important, however, consider strategizing towards holding exclusively short-term bonds in your fixed-income portfolio. You can use funds like the SPDR Short Term Municipal Bond Index (SHM) or the Vanguard Short-Term Bond Fund (BSV), both of which holds over a 1000 individual bonds. Rates are likely to rise throughout 2016 and 2017. Today's market is a rare opportunity to capitalize on upswings explicitly cited in advance and position your portfolio for the next bear market.

[1] Cox, Jeff. Fed Chair Yellen: ‘Unwise’ to wait too long to hike interest rates. February 14, 2017. CNBC

[2] Glassman, James K. Why I’m Still bullish on Bonds. April, 2015. Kiplinger

[3] Harrison, David. Fed Eyes Aggressive Rate Increase. The Wall Street Journal. February 23, 2017.

[4] Howard, Copper J. and Williams, Rob. Short-Term Bonds: Why They Could Outperform As Interest Rates Rise. Charles Schwab. February 2, 2017.

[5] Saphir, Ann. Fed’s Yellen says ‘makes sense’ to gradually raise interest rates. Reuters. January 18, 2017.